Recently, the new energy vehicle industry has been reminded to be cautious about metal resource shortages, with the "copper shortage" being particularly severe.

On February 28th, media reported that European car manufacturer Stellantis is acquiring a company operated by mining entrepreneur Rob McEwen, which could potentially give the automaker access to a huge copper mine in Argentina.

At that time, some analysts stated that competition among companies for various metals used in the manufacturing of electric vehicles was heating up. Stellantis' investment in the copper mine is slightly over $150 million, which is not significant. But this once again reminds people how eager car companies are to lock in the supply of materials needed to manufacture electric vehicles in the future.

High demand and irreplaceable

The above analysis is by no means alarmist. It should be noted that electric vehicles consume three to four times more copper than traditional internal combustion engines.

Specifically, data shows that the current copper consumption of hybrid batteries is 60kg pervehicle, and that of pure electric vehicles is at least 83kg pervehicle (copper consumption of electric buses is 224-369kg pervehicle, and pure electric new energy vehicles are temporarily calculated at 100kg pervehicle).

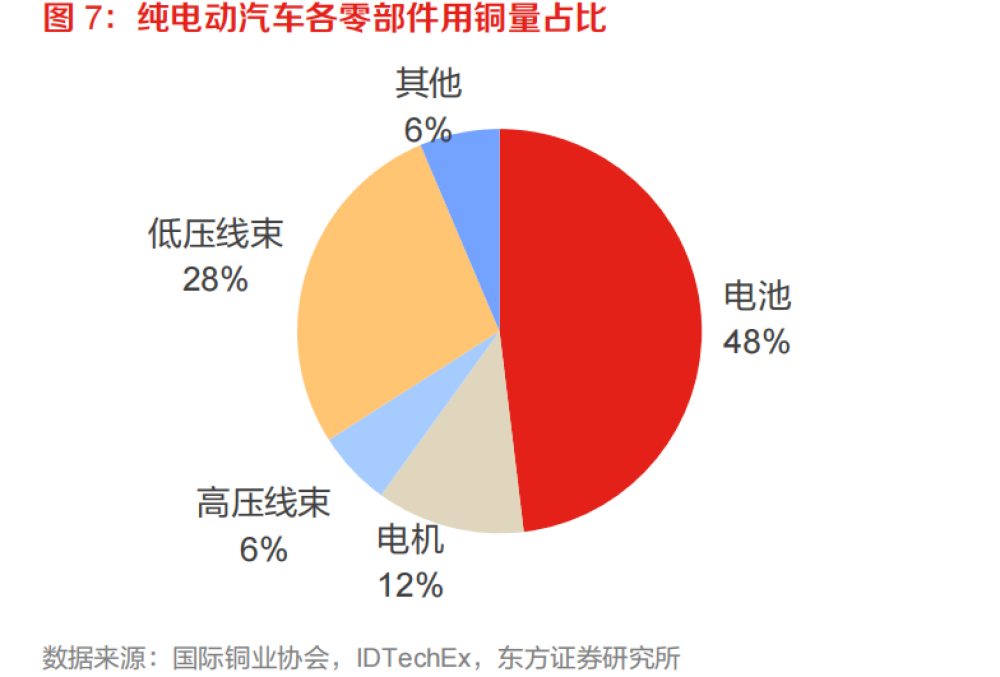

What parts of new energy vehicles do these copper play a role in?

In the field of new energy vehicles, copper is mainly used in areas such as batteries, wiring harnesses, motors, and charging stations.

Source: Dongfang Securities

First, look at the battery. As an indispensable raw material for power lithium batteries, lithium copper foil is the most commonly used part of copper in electric vehicles. Copper foil is a key material for the negative electrode of lithium-ion batteries, which has a significant impact on the energy density and other performance of the battery, accounting for approximately 5-8% of the cost of lithium-ion batteries. As the main raw material for lithium battery copper foil, copper accounts for 79% of the product cost, and a high copper price will directly lead to an increase in copper foil prices.

In addition, since 2016, tight supply has also led to a continuous increase in the price of lithium copper foil. It is reported that the processing fee for lithium battery copper foil has increased from 32000 Yuan perton to 38000 Yuan perton, and the payment method has also changed from "1-3 month payment period" to "cash, or even prepayment". Even within the industry, there are analysts asserting that "lithium battery copper foil is likely to repeat the imbalance between supply and demand of lithium carbonate and lithium hexafluorophosphate in 2015, with prices skyrocketing

Next is the wiring harness. According to a research report from Dongfang Securities, the amount of copper used in the low-voltage wiring harness of electric vehicles is 5 kilograms more than that of gasoline vehicles, reaching 23 kilograms. And with the deepening of electric vehicle networking and intelligence, cars are providing more and more functions such as ADAS and information entertainment systems, which will require the layout of more and more complex low-voltage wiring harness systems. In addition, the high-voltage wiring harness of electric vehicles requires high conductivity, and it is expected that advanced copper alloy materials will be used in the high-voltage system of electric vehicles in the future. It is expected that by 2025, the total market size of copper wire harnesses for electric vehicles in China will reach 18.8 billion yuan, with an annual compound growth rate of 30%.

Once again, it's the motor. The drive motor is the power source of electric vehicles, and the electromagnetic coil is made of copper rods. According to statistics from the International Copper Industry Association and IDTechEx, the average motor power of each pure electric vehicle and plug-in hybrid vehicle is 139kW and 100kW, respectively. The copper consumption of permanent magnet synchronous motors is 0.09kg/kW, indicating that the copper consumption of each pure electric vehicle and plug-in hybrid vehicle is 12.3kg and 8.9kg, respectively.

Finally, there is the charging station. At present, high-pressure fast charging is the best choice to solve the current range problem of electric vehicles. In 2022, multiple domestic car companies have started to follow up on 800V high-voltage fast charging, such as Xiaopeng Automobile, GAC Aian, BYD e-platform, Geely Geely Krypton, Ideal Automobile, BAIC Jihu, etc. It is reported that each AC charging station uses 2-8 kilograms of copper, while DC charging stations use 60 kilograms of copper. According to the prediction of Dongfang Securities, the market size of copper materials for electric vehicle charging piles in China will reach 3.1 billion yuan in 2025, with an average annual compound growth rate of 36%.

.png)

Image source: Jikrypton official website

According to data from the International Copper Research Organization, the unit copper consumption of new energy vehicles is 83 kilograms per vehicle; It is expected that the global sales of new energy vehicles will reach 22.5 million units in 2026, corresponding to a copper consumption of approximately 1.868 million tons; It is estimated that the copper consumption of new energy vehicle charging piles is about 115000 tons, with a total of 1.983 million tons, with a compound annual growth rate of 30%.

By 2023, according to the prediction of the China Automobile Association, the total sales of traditional cars this year will be 27.6 million units, a year-on-year increase of 3%. Assuming that the production and sales of traditional cars maintain the same growth rate, the expected increase in copper consumption for traditional cars this year is 19000 tons. This year, the total sales of new energy vehicles will reach 9 million units, an increase of 38% year-on-year. Assuming that the production and sales of new energy vehicles maintain the same growth rate, it is expected that the domestic new energy vehicle industry will add approximately 222000 tons of copper in 2023.

It is worth noting that unlike other metal materials in power batteries, there is no substitute for copper in electric vehicles. However, with such high and inevitable demand, there won't be so many new or expanded mines to meet the copper demand for electric vehicle production at that time? This has forced the entire industry chain of new energy vehicles to face up to copper prices and the exploitation of copper resources.

Will copper reserves be depleted in 2023?

According to Ming.com, in the fourth quarter of 2022, copper prices have risen from $3.25 per pound at the end of the third quarter to $4.35 per pound, an increase of over 25%. Although they have fallen since the beginning of 2023, they are still trading above $4 per pound. Goldman Sachs estimates in 2023 that copper prices are expected to rise to $12000 per ton in 2024.

A recent survey released by MLIV Pulse also shows that retail investors (45%) and professional investors (36%) expect copper to surpass gold, corn, and crude oil as the best-performing commodity this year.

Analysis has pointed out that the increasing volume of the electric vehicle market has provided important incentives for copper to start rising. Mining and commodity giant Glencore believes that under the International Energy Agency's (IEA) net zero emission policy path, global copper shortages will exceed 50 million tons between 2022 and 2030.

Specifically, in 2023, Colin Moorhead, Executive Chairman and Managing Director of Xanadu Xianledu Mining Company, stated: "In the context of global energy transformation, copper mining enterprises are expected to enter a super cycle like lithium mines." He also pointed out that 2023 may be the year when copper reserves are depleted.

However, at the critical point where copper reserves are about to be depleted, China's copper resources are not abundant, accounting for only about 3% of the global total, and the resource endowment conditions are poor.

According to relevant data, in 2021, China's copper concentrate production reached 1.855 million tons, which could only meet 17.7% of the refining production demand. This led to a net import of 23.428 million tons of copper ore and its concentrate in 2021, an increase of 7.4% compared to the previous year, and an import of 1.693 million tons of copper waste and crushed materials, an increase of 79.6% compared to the previous year. The overall dependence on foreign copper mines reached 82%.

In recent years, relevant mining enterprises in China have been actively expanding the territory of domestic and foreign copper mines.

.png)

The figure shows the global distribution of copper mines in Zijin Mining, sourced from the official website of Zijin Mining

In April 2022, Zijin Mining and Xanadu Mines Ltd, a copper and gold listed company, reached an investment cooperation plan to jointly promote the development of the Kharagtai project, a huge copper and gold mine owned by Xanadu Xianledu Mining in South Gobi, Mongolia. According to research reports from relevant securities firms, Hamagotai is one of the largest known undeveloped copper and gold resource projects worldwide. According to the latest estimate, the total amount of ore is 1.1 billion tons, containing approximately 3 million tons of copper and 8 million ounces of gold.

In June of the same year, Zijin Mining announced that it planned to acquire 50.1% equity of Julong Copper Industry through a wholly-owned subsidiary, Tibet Zijin, with a cash contribution of 3.883 billion yuan. It is reported that Julong Copper has a total of 7.9576 million tons of copper metal. The annual report shows that as of the end of 2019, Zijin Mining's copper resource reserves were approximately 57.2542 million tons, accounting for approximately 50.03% of the total domestic amount. During the same period, the national copper reserves were 114.4349 million tons.

This means that with the acquisition of Julong Copper, the copper resource reserves controlled by Zijin Mining will increase to 65.2118 million tons, accounting for 56.99% of the domestic total, further highlighting its position as a giant.

However, in recent years, the return on overseas investment of Chinese mining enterprises has been poor. For example, Minmetals Group owns a super large copper mine, Las Bambas, in its overseas copper mines, which has obvious advantages in scale and cost. However, the acquisition cost is high, bringing significant debt pressure and financial expenses. In the future, as production increases and copper prices rebound, there is a high probability that profitability will be enhanced. However, the remaining copper mines in the group have an average scale and are basically on the brink of breakeven.

.png)

Source: Minmetals Group official website

In addition, car companies are also entering the field of copper materials. In September 2022, according to information on General Motors' official website, the company will invest $491 million in its metal stamping plant in Marion, Indiana, to prepare for the future production of steel and aluminum stamping parts for automobiles, including electric vehicles produced at multiple General Motors assembly plants.

Coincidentally, Ford and Rio Tinto recently signed a memorandum of understanding to develop and produce low-carbon footprint copper. Industry expectations suggest that copper shortages may lead companies to adopt further direct procurement strategies.

Will copper "repeat" the "mistakes" of lithium?

At present, copper resources are showing signs of tightening, inevitably reminiscent of lithium carbonate, which has previously plagued new energy vehicle companies with high prices. Can copper become a new "anxiety" for new energy vehicle companies?

Firstly, from a resource perspective, like lithium resources, copper resources in China do not have an advantage, and most copper mines are distributed overseas. In addition, most of these mines are located in Chile and Peru, two South American countries with increasingly volatile political and social environments. For example, Peru has recently experienced anti government protests, with production problems at large mines such as Las Bambas, Antapacacay, and Cerro Verde. Peru is the world's second largest copper producer, accounting for nearly 10% of global copper production.

.png)

Source: Zijin Mining Official Website

In addition, when domestic resources are limited, and most of the time overseas, the pricing power of copper resources also has a great possibility of being sidelined.

From the perspective of the scope of use of copper resources. Unlike lithium, copper has a greater demand side. For electric vehicles, copper is not limited to new energy power batteries, but is distributed throughout most automotive components. In addition, the application of copper is not only limited to the new energy vehicle industry, but also an important part of the global decarbonization plan, such as photovoltaic, wind power, and energy storage.

According to relevant calculations, the global copper consumption of photovoltaic installation in 2025 will reach 1.32 million tons, an increase of 154% from the 520000 tons of global copper consumption in 2020; The global annual installed copper consumption of wind power in 2025 will reach 561000 tons; In 2025, the global increase in electrochemical energy storage capacity of copper will reach 180900 tons.

It is even more noteworthy that from a global perspective, the shortage of copper raw materials is not due to insufficient resources, but rather the inability of mining time to meet demand. It is reported that the cycle from discovering copper deposits to production has been extended to over 10 years, and 20 years is not uncommon for large-scale projects.

But at present, the anxiety of copper supply shortage has not yet been transmitted to new energy vehicle companies, and there will not be a fierce competition like lithium mines in the short term. The layout of copper mine production is still only staged among mining companies. This is mainly due to the fact that copper prices are still within the downstream tolerance range.

Take copper foil as an example. According to the research report of Dongfang Securities, due to the small proportion of copper foil cost in the total battery cost, downstream manufacturers will have a high tolerance for the increase in their processing fees.

According to its calculation, the cost of lithium battery copper foil accounts for 5-8% of the total cost of lithium batteries μ Every 5000 yuan increase in copper foil processing fee only leads to a 208 yuan increase in the total cost of a single battery, accounting for 0.32% of the total cost; four point five μ Every 5000 yuan increase in copper foil processing fee only leads to a 120 yuan increase in the total cost of a single battery, accounting for 0.25% of the total cost. Therefore, the increase in copper foil processing costs has little impact on the overall cost of batteries, and downstream battery manufacturers have a certain tolerance for the price increase of lithium copper foil.

However, the metal resource anxiety in the new energy vehicle industry is not limited to lithium and copper. According to the International Energy Agency (IEA) report, the average mineral requirements for electric vehicles are as follows: copper: 53.2 kilograms per vehicle, lithium: 8.9 kilograms per vehicle, nickel: 39.9 kilograms per vehicle, manganese: 24.5 kilograms per vehicle, cobalt: 13.3 kilograms per vehicle, graphite: 66.3 kilograms per vehicle, rare earth: 0.5 kilograms per vehicle, and others: 0.3 kilograms per vehicle. As a comparison, traditional fuel vehicles only require copper: 22.3 kilograms per vehicle; Manganese 11.2 kg/vehicle, others 0.3 kg/vehicle.